2025 Restaurant Accelerator & Community Fund Grant

National ACE, in partnership with Grubhub, is proud to announce the opening of applications for the 2025 Restaurant Accelerator and Community Fund Grant, a program made possible by grant support from the Grubhub Community Fund.

From October 1 to October 24, small, independent restaurants across the United States can apply for the chance to join a program designed to spark growth, innovation, and long-term success. Applicants who attend at least three of National ACE’s expert-led virtual Restaurant Accelerator sessions in November will be eligible to receive a $5,000 Community Fund Grant to invest directly in their business.

Sessions occur on November 4, November 12, November 18, and November 25. Accelerator sessions start at 4:00 PM ET.

Who can apply?

The program is open to U.S.-based small, for-profit restaurants that are currently operational and licensed in food preparation and service. While the grant is open to all eligible businesses, we encourage Asian American and Pacific Islander restaurateurs operating in economically disadvantaged areas to apply. Below is the full list of eligibility requirements:

The restaurant must be classified as a small business;

Open to all small businesses that meet the standard SBA definition of a small business.

While eligibility is not limited by background, the program strongly encourages applications from business owners of Asian American and Pacific Islander (AAPI) heritage who operate in economically disadvantaged areas (as defined by local or federal economic development zones).

Must be based in the United States;

Must be currently operational;

Must be a for-profit business;

Must show proof of their primary licensed activity as “the preparation and serving of food”;

Cannot be a franchise;

Funds must be used towards growth and expansion of the business;

Must attend at least 3 out of the 4 sessions of the accelerator program (11/4, 11/12, 11/18, 11/25)

Important Dates

Registration Opens: Oct 1, 2025

Registration Deadline: 11:59 PM EST on Oct 24, 2025

**The application closes at 11:59 PM EST on October 24, 2025. Please note that due to the program’s high demand, the application portal will close once we have received 500 applications, even if that occurs before the October 24 deadline, so we are highly encouraging small business owners to apply as early as possible during the application open period. Late applications will not be accepted.

Virtual Accelerator Sessions: Nov 4, 12, 18 & 25, 2025

Grant Recipients Announced: Nov 25, 2025

Accelerator

Join National ACE and Grubhub for a series of virtual accelerator sessions designed to help restaurateurs strengthen their operations, grow their brands, and achieve long-term success. Applicants for the Restaurant Accelerator and Community Fund Grant must attend at least 3 of the 4 sessions to qualify for the $5,000 grant. However, these sessions are open to all small, independent restaurant owners who want to gain valuable insights from industry experts and learn proven strategies for business growth.

-

Don't Leave Money on the Table

November 4, 2025

4 - 5 PM ET -

Ask the Experts: The Direct Path to a Digital Restaurant Presence

November 12, 2025

4 - 5 PM ET -

Gain More Customers

November 18, 2025

4 - 5 PM ET

-

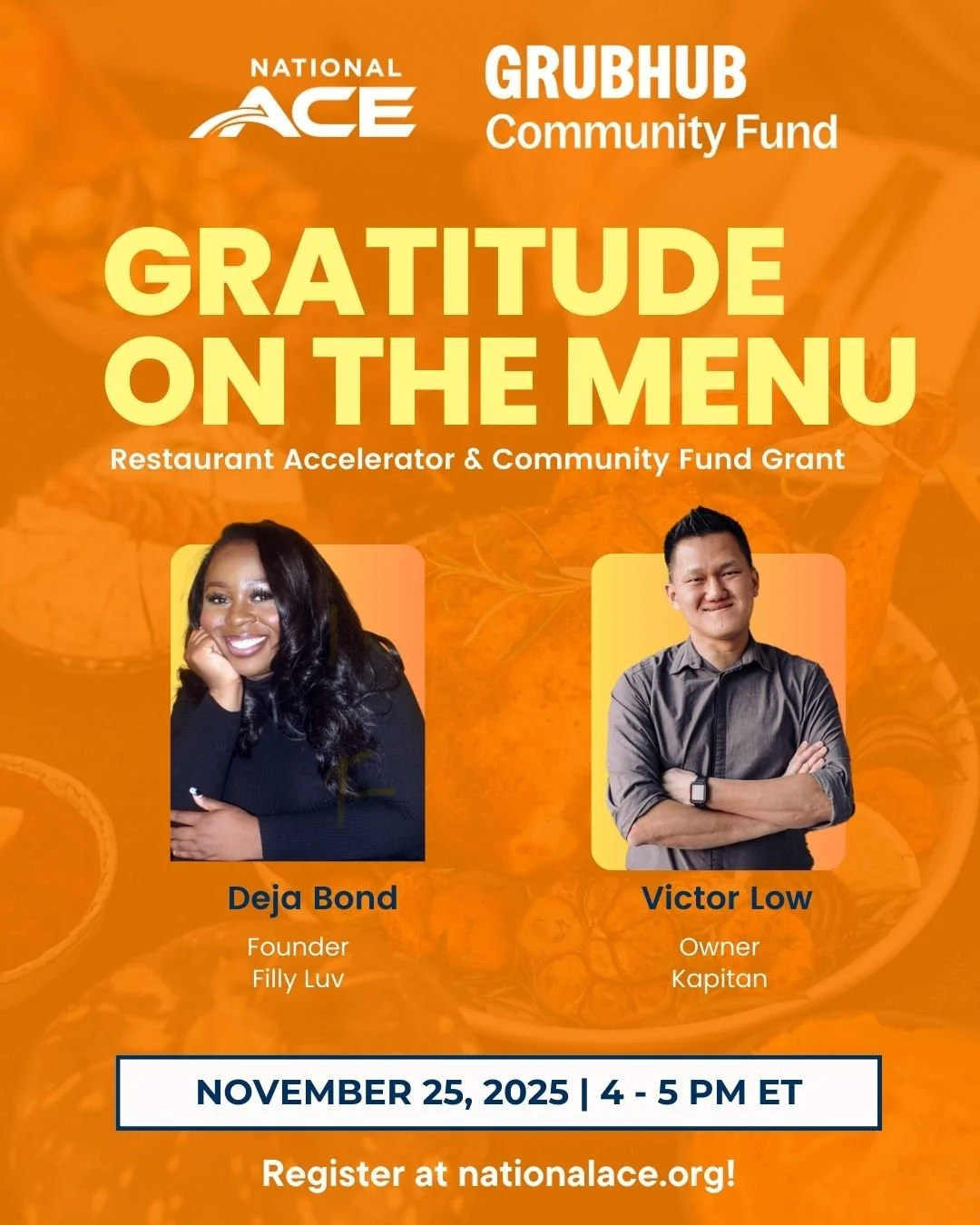

Gratitude on the Menu

November 25, 2025

4 - 5 PM ET

Frequently Asked Questions

-

The application closes at 11:59 PM EST on October 24, 2025. Please note that due to the program’s high demand, the application portal will close once we have received 500 applications, even if that occurs before the October 24 deadline, so we are highly encouraging small business owners to apply as early as possible during the application open period. Late applications will not be accepted. Note that it closes on the Eastern Time Zone. Do not wait until the last hour, we do not offer extensions. If you experience any technical difficulties with Submittable, please contact the Submitter Resource Center immediately. National ACE cannot assist with technical issues.

-

No, you do not need to be a U.S. citizen to apply.

-

Yes, a Submittable account is required to apply, and free to create.

-

Grant recipients will be announced in late November 2025 and will be contacted for next steps shortly after.

-

If you are chosen as a grant recipient, please be prepared to share your testimony on how the funding helped your business.

Grantees photos may also be used in promotional materials.

-

A Certificate of Good Standing simply indicates that the entity has filed all reports and paid the necessary fees with the Secretary of State's office. It serves as proof, or evidence, that the entity exists and is authorized to transact business in the state.

You can get a Certificate of Good Standing from the business filing agency in your state. In many cases, this is your Secretary of State Office (or one of its subdivisions). However in some cases, you'll need to find the equivalent agency that's responsible for filing entities and maintaining state records. If you are having trouble finding it, Certificates of Good Standing are sometimes also known as Certificates of Status, Certificates of Existence, or Certificates of Compliance. It may be called something different depending on the state your business is registered in.

If you don't have one at the moment, you can submit a document that shows that you have applied for one and are waiting for your state to get back to you. If you are a sole proprietor, you can submit a document saying that you are a sole proprietor and don't need a certificate of good standing.

-

Due to the high volume of applications we receive, we may not be able to respond to individual requests for updates. However, you can check at any time on the status of your application via Submittable.

-

We will notify all applicants about the status of their submission in November via the email provided in your application. Be sure to check your email regularly, including your junk folders. Email updates to all applicants will come from Submittable. If someone assisted you in the physical completion of the application form, please be sure to include their email address when asked. This will ensure they are able to receive a copy of the status email as well.

Grant recipients will receive next steps from info@nationalace.org. Failure to reply promptly to next steps may result in disqualification from the grant program.

-

No, grant funds do not need to be repaid. However, all taxes associated with the acceptance and/or uses of cash awarded are the sole responsibility of the individual grantee. Cash awarded will be reported by National ACE Foundation to the IRS as National ACE Foundation deems necessary according to applicable law. It is further the policy of National ACE Foundation that all grantees be advised to consult with their own tax professionals and/or legal counsel to ascertain the tax impact of the cash awards.

-

For grant-related questions, please contact info@nationalace.org.

For technical assistance, please view the Submitter Resource Center or contact Submittable Customer Support.